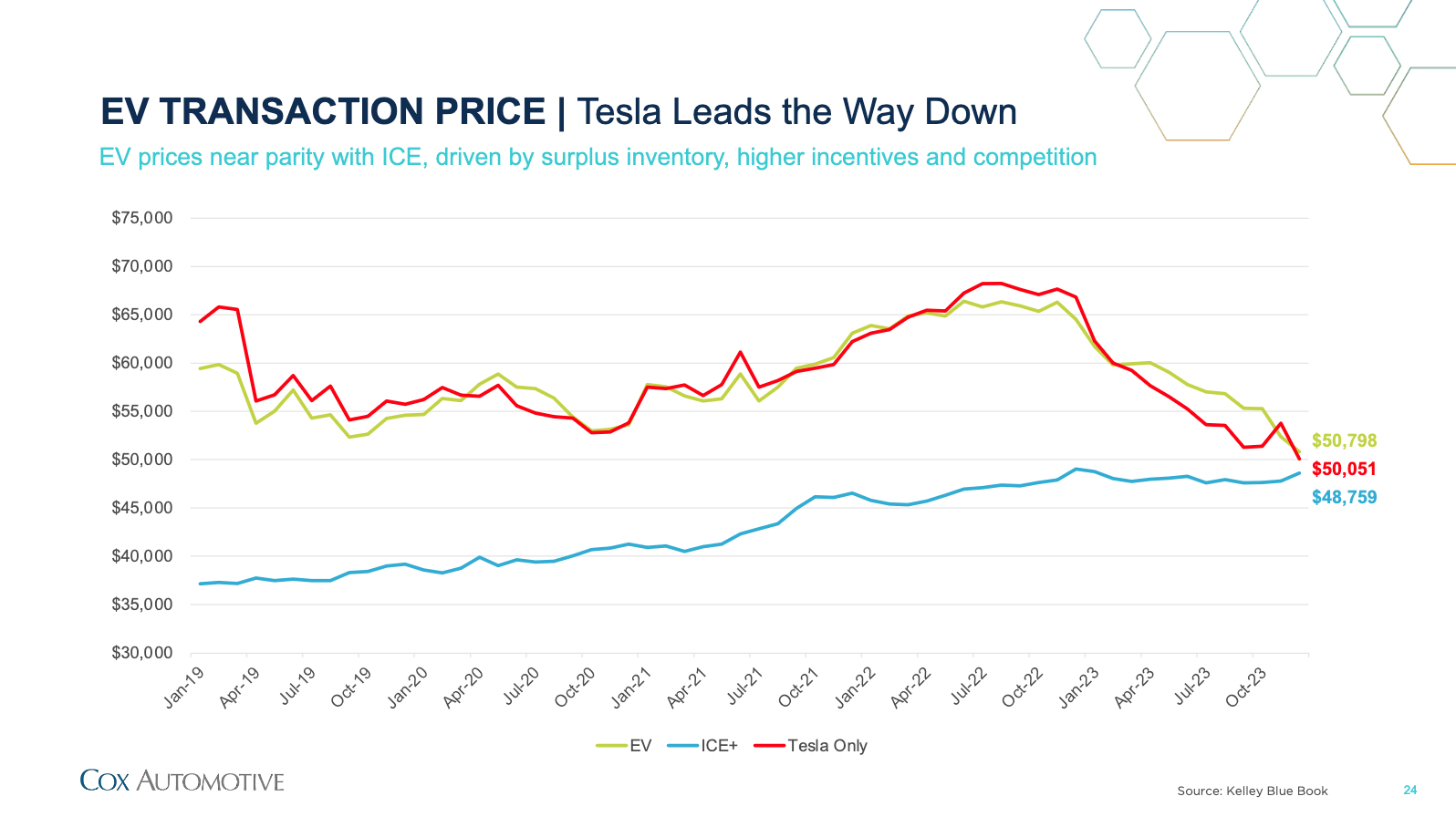

In 2023, Tesla played a significant role in narrowing the price gap between electric vehicles (EVs) and internal combustion engine (ICE) cars, moving the EV market toward price competitiveness, according to Cox Automotive.

Im Jahr 2023 sanken die Listenpreise für Elektrofahrzeuge (EV) weiter und näherten sich den Preisen für Benzinautos an, was größtenteils auf die proaktiven Preissenkungen von Tesla zurückzuführen war. Die als „Automobil-Preiskrieg“ bezeichneten erheblichen Preissenkungen von Tesla für die gesamte Fahrzeugpalette zu Beginn des Jahres übten erheblichen Druck auf die Branche aus. Laut einem Bericht von Cox Automotive, der in einem kürzlichen Webcast vorgestellt wurde, leiteten diese Preissenkungen von Tesla im Laufe des Jahres einen allmählichen Rückgang der EV-Preise ein und brachten den Markt näher an die Preisparität mit Fahrzeugen mit Verbrennungsmotor (ICE).

Die Daten zeigen, dass der durchschnittliche Listenpreis von Tesla im Laufe des Jahres stetig sank und im Dezember 50.051 US-Dollar erreichte. Dieser Betrag lag in unmittelbarer Nähe des Durchschnittspreises von 48.759 US-Dollar für ein Fahrzeug mit Verbrennungsmotor im selben Monat.

Ähnlich wie Tesla verzeichnete der gesamte Automobilsektor einen durchschnittlichen Listenpreis für Elektrofahrzeuge von 50.798 US-Dollar, was einen ähnlichen Abwärtstrend im Jahresverlauf widerspiegelt. Darüber hinaus ist der durchschnittliche Gesamtpreis für ein Elektrofahrzeug von 52.362 US-Dollar im November gesunken.

Unten sehen Sie ein Diagramm, das die durchschnittlichen Transaktionspreise von Elektrofahrzeugen im Zeitverlauf zeigt und den Trend für Tesla, Elektrofahrzeuge insgesamt und Fahrzeuge mit Verbrennungsmotor veranschaulicht.

Im Jahr 2023 setzte sich der Abwärtstrend bei den Listenpreisen für Elektrofahrzeuge (EV) fort und näherte sich der Preisparität mit benzinbetriebenen Fahrzeugen. Dieser Wandel war größtenteils auf die aggressiven Preissenkungen von Tesla zurückzuführen, die einen sogenannten „Preiskrieg“ in der Automobilbranche auslösten. Im Laufe des Jahres senkte Tesla die Preise für seine gesamte Fahrzeugpalette erheblich und übte damit einen enormen Druck auf die gesamte Branche aus. Laut einem Bericht von Cox Automotive, der in einem kürzlichen Webcast hervorgehoben wurde, löste dieser Schritt von Tesla einen allmählichen Rückgang der EV-Preise aus und brachte den Markt näher an die Kosten für Fahrzeuge mit Verbrennungsmotor (ICE).

Die Daten deuten auf einen stetigen Rückgang des durchschnittlichen Listenpreises eines Tesla im Jahresverlauf hin und lag im Dezember bei 50.051 Dollar – ein Wert, der nicht weit vom Durchschnittspreis von 48.759 Dollar für ein Fahrzeug mit Verbrennungsmotor im gleichen Zeitraum entfernt ist.

Nach Teslas Beispiel erlebte die gesamte Autobranche einen ähnlichen Abwärtstrend bei den durchschnittlichen Listenpreisen für Elektrofahrzeuge, die sich bis zum Jahresende bei 50.798 US-Dollar einpendelten. Darüber hinaus sank der durchschnittliche Gesamtpreis für ein Elektrofahrzeug von 52.362 US-Dollar im November.

Cox führt diesen Abwärtstrend bei den Elektrofahrzeugpreisen auf die Preisanpassungen und Anreize von Tesla sowie die Einführung günstigerer Elektrofahrzeugoptionen auf dem Markt zurück.

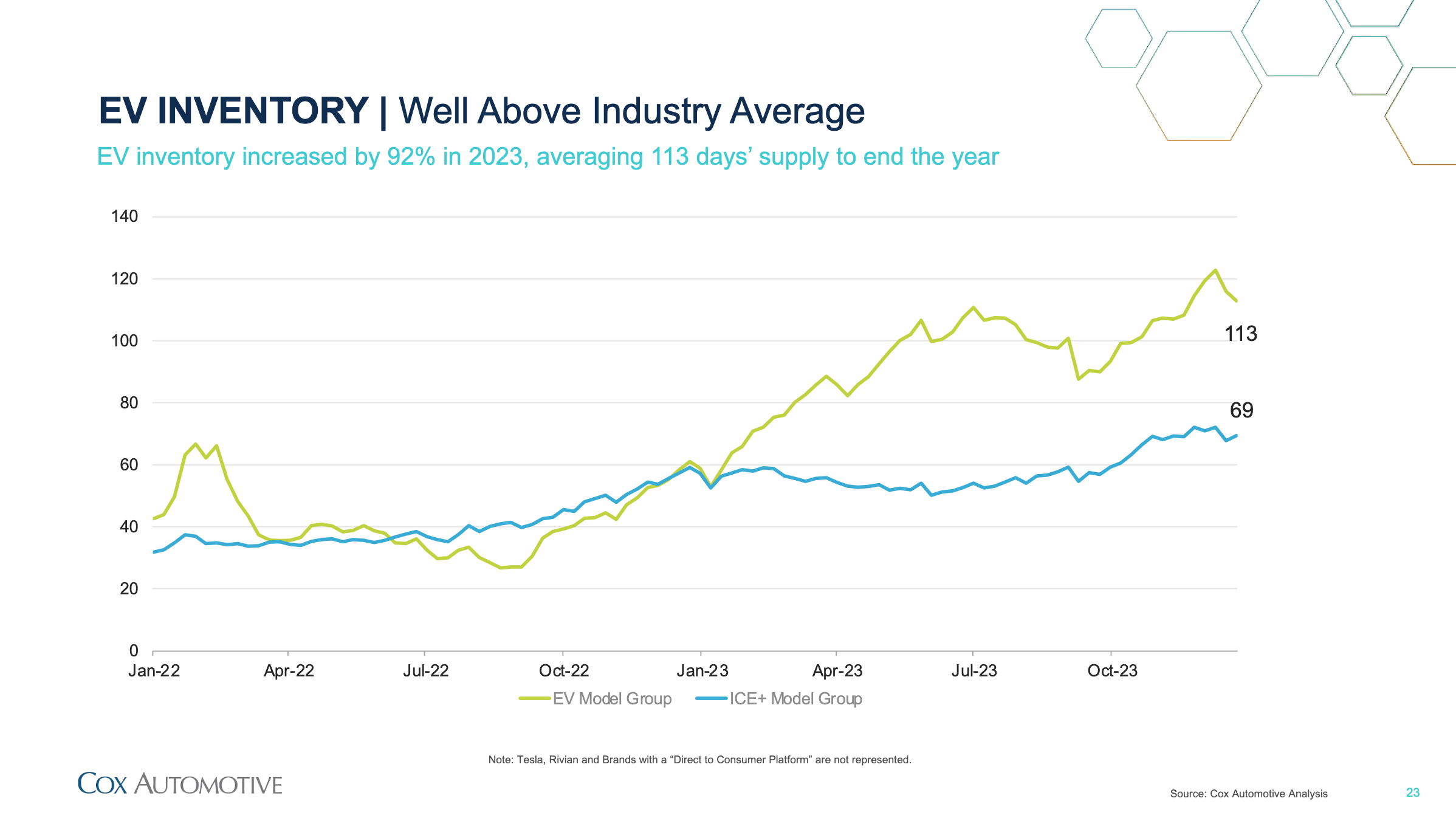

Während einige Automobilhersteller jedoch mit erhöhten Lagerbeständen an Elektrofahrzeugen im Vergleich zu Fahrzeugen mit Verbrennungsmotor zu kämpfen haben (ein Anstieg von 92 %, wobei die Händler zum Jahresende durchschnittlich Vorräte für 113 Tage vorrätig hatten), sind Unternehmen wie Tesla und Rivian in diesen Daten nicht enthalten, da sie mit ihren Direktvertriebsmodellen deutlich geringere Lagerbestände vorhalten.

Obwohl Cox beabsichtigt, im Laufe dieser Woche einen umfassenden EV-Bericht zu veröffentlichen, deuten die ersten Erkenntnisse auf eine sich verändernde Landschaft in der EV-Preisdynamik hin. Sie können hier auf die vollständige Webcast-Wiederholung zugreifen oder hier den vollständigen Satz der Präsentationsfolien für weitere Einzelheiten ansehen, bis der ausführliche Bericht verfügbar ist.

--------Der Artikel stammt aus TESLARATI.