Tesla's Game-Changer: Affordable €25,000 Car Production in German Gigafactory

The latest buzz in the online sphere centers around Tesla's purported plans to produce a car with a starting price of €25,000 ($26,838) at its Grünheide, Germany factory, as per an anonymous insider cited in a Reuters report. Although production commencement remains undisclosed, the news has spurred speculation. Notably, our recent coverage on the pressure facing Tesla's stock prices may have motivated Elon Musk and his team to embark on the challenge of creating a car with a price tag below half of the current European average for new electric cars, which stands at €65,000, as reported by Reuters. In comparison, the average electric car price in China hovers around €31,000.

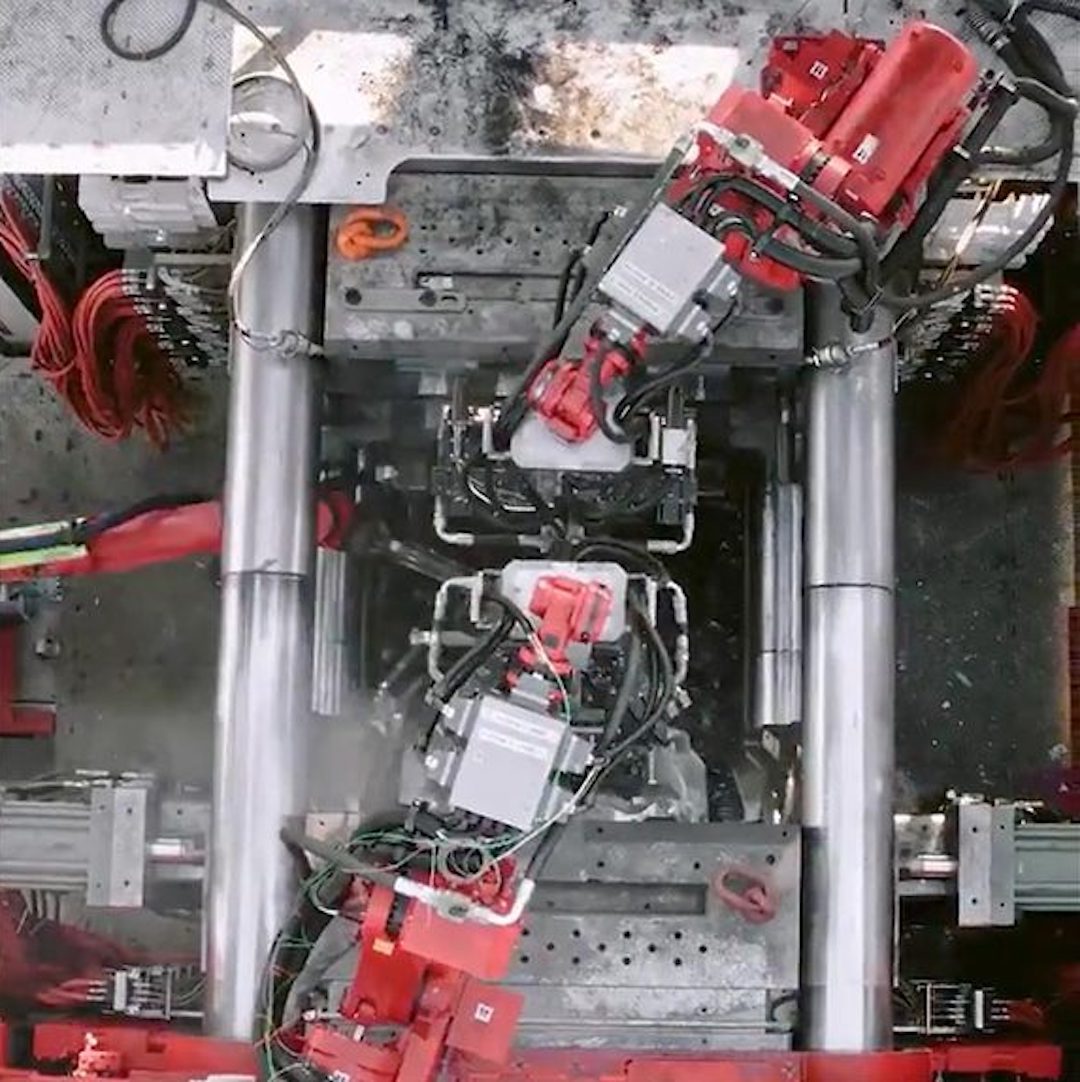

Back in September, insider reports indicated that Tesla was on the verge of achieving the capability to die-cast the entire structural framework of a car, a groundbreaking innovation poised to substantially reduce production costs. This significant manufacturing breakthrough, once achieved, is expected to empower Tesla to introduce cars at price points lower than any of its current models.

In September, we also covered Tesla's notable progress in refining the die-casting process, outlining some remaining challenges on the path to full-scale production. Successful die casting has the potential to eliminate approximately 400 individual metal stampings, which typically require welding, gluing, riveting, or bolting to assemble the car's structural foundation.

Tesla initiated its high-pressure casting patent application in 2019 and has since mastered the casting of both the rear and front sections. The current goal is to seamlessly cast the entire front, rear, and central sections as one integral unit—a feat previously accomplished only by Hot Wheels and Matchbox manufacturers.

If Tesla can successfully implement this process, its manufacturing costs could plummet by up to 50%, placing significant competitive pressure on other automakers to adapt or face an increasingly challenging landscape. Notably, in February 2022, Volvo announced its plans to utilize high-pressure die casting for certain car components, and Chinese companies Nio and XPeng are also considering adopting this innovative approach.

Tesla Discovers Die Casting Is No Walk in the Park

Terry Woychowsk, with over three decades of experience at General Motors, emphasized in a September interview with Reuters that if Tesla successfully incorporates extensive underbody casting in an electric vehicle, it could have a profound impact on the automotive industry, revolutionizing vehicle design and production. He described it as a transformative enabler but acknowledged the significant challenges involved, particularly when dealing with larger and more complex castings. At the time, there were speculations that Tesla would make a decision regarding high-pressure die casting within approximately three months. Now, two months later, the buzz surrounding casting is growing louder and more persistent.

One of the primary hurdles in implementing high-pressure castings lies in designing sub-frames that are hollow yet equipped with internal ribs to effectively dissipate forces during collisions. According to sources, design and casting specialists in the UK, Germany, Japan, and the US are leveraging 3D printing and industrial sand to address some of these intricate challenges.

Creating the molds essential for the high-pressure casting of substantial components can be a costly and risky endeavor. Modifying a large metal test mold during the design phase can incur expenses of up to $100,000, while the complete reiteration of the mold may range from as low as $1.5 million to as much as $4 million, depending on the insights of anonymous experts.

For numerous automakers, the perceived costs and risks have deterred them, especially when the design process often necessitates multiple adjustments—sometimes six or more—to achieve an ideal die, taking into account factors such as noise and vibration, fit and finish, ergonomics, and crash resistance. However, Elon Musk, known for pioneering rockets that fly in reverse, tends to embrace challenges and is less daunted by risks.

Tesla has reportedly turned to companies that utilize 3D printing and industrial sand to create test molds for its casting process. These molds, constructed layer by layer with a liquid binding agent on thin layers of sand, can be used for die casting molten alloys based on digital design files. This approach, which costs only about 3% of what a metal prototype would, provides Tesla with greater flexibility to make multiple adjustments to prototypes rapidly. The design validation cycle using sand casting also takes significantly less time, ranging from two to three months, compared to six months to a year for metal molds.

Nonetheless, the aluminum alloys used in the castings presented a challenge, as they behaved differently in sand molds compared to metal molds, resulting in prototypes that didn't meet Tesla's specifications. To address this issue, casting specialists formulated special alloys, fine-tuned the alloy cooling process, and developed a post-production heat treatment.

For Tesla's upcoming small car/robotaxi, the company sees an ideal opportunity to cast an EV platform as a single piece, particularly because the underbody is simpler and lacks a significant front and rear overhang. The challenge for Tesla now lies in determining the type of press to use for its die casting plan. Manufacturing large body parts quickly requires sizable casting machines with clamping power of 16,000 tons or more, which can be costly and necessitate larger factory buildings. To accommodate the 3D-printed sand cores required for hollow subframes, Tesla is considering using a different type of press capable of injecting molten alloy at a slower pace, producing higher quality castings.

While the possibility of more affordable electric cars from Tesla is promising, there are several unanswered questions and concerns. For instance, the repairability and cost of fixing a die-cast car after a collision remain uncertain. Some people fear that these vehicles could become "throwaway" cars if repair costs are prohibitively high. The implications for insurance costs and recyclability are also unclear.

Additionally, the challenges related to Tesla's factory expansion in Grünheide, Germany, and the environmental concerns raised by community groups and local regulators could potentially delay the introduction of the new die-cast assembly line. Water availability is a particular concern in this context.

Lastly, it's unclear whether these new cars are designed for private passenger use or intended for use in Tesla's envisioned robotaxi fleet. The development of autonomous driving systems needed for robotaxis is still a work in progress, with some experts suggesting they may not be widely available before 2030 at the earliest.

Elon Musk personally visited the factory in Germany on November 3 to express gratitude to the staff for their hard work and to announce Tesla's plans to build a €25,000 car. In addition, Tesla informed its workers that they would receive a 4% pay increase starting in November, with production workers receiving an extra €2,500 per year beginning in February 2024. This equates to an 18% pay raise over the next 18 months.

It's worth noting that in 2022, German union IG Metall stated that Tesla's wages were approximately 20% lower than those offered under collective bargaining agreements at other automakers. The question of whether the recent UAW strike and contract negotiations influenced this decision remains open for interpretation.

---------This article is partly excerpted from Reuters.